Details

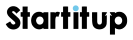

Introducing our Self-Assessment Property Income service, where we provide comprehensive assistance for individuals managing property income in their self-assessment tax returns. Whether you’re a landlord, property owner, or investor, our tailored approach ensures accurate reporting and compliance with tax regulations. From rental income to allowable expenses and capital gains, we navigate the complexities of property taxation to ensure your self-assessment is completed efficiently and accurately. Let’s collaborate to optimize your tax position and ensure you meet your obligations while maximizing returns from your property investments.

Our Service :

- Assistance with self-assessment tax returns for property income.

- Accurate recording and reporting of rental income and expenses.

- Expert guidance on allowable deductions and tax reliefs related to property income.

- Compliance with HMRC regulations for self-assessment tax filing.

- Handling of property-related documentation and correspondence with HMRC.

- Dedicated support to address any queries or issues related to self-assessment property income tax.

Additional information

| package | Basic, Standard, Premium |

|---|

Startup

Startup Accounting

Accounting Artwork

Artwork Tech

Tech Marketing

Marketing E-commerce

E-commerce Trade

Trade Legal

Legal

There are no reviews yet.